Healthcare access remains a critical issue in Ghana, where a significant portion of the population faces financial barriers to medical services. While the National Health Insurance Scheme (NHIS) has made strides in improving coverage, gaps still exist, especially for low-income earners and those in informal sectors. This is where microinsurance steps in—offering affordable, targeted health insurance solutions that ensure broader healthcare access.

In this article, we’ll explore the impact of microinsurance on Ghana’s healthcare landscape, its benefits, challenges, and how it can be leveraged to drive universal health coverage.

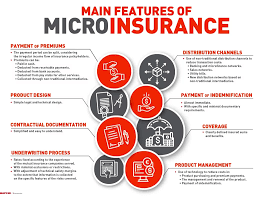

What is Microinsurance?

Microinsurance is a type of insurance designed for low-income individuals and families who might otherwise struggle to afford traditional insurance policies. It provides affordable, accessible, and customized insurance products tailored to the financial realities of economically disadvantaged groups.

In Ghana, microinsurance policies are typically:

✔ Low-cost – Premiums are affordable for low-income earners.

✔ Simplified – Policies have minimal documentation and easy enrollment.

✔ Flexible – Payouts and coverage are structured for informal workers.

These features make microinsurance an effective tool for bridging the healthcare gap in Ghana.

The Importance of Microinsurance in Expanding Healthcare Access

1. Reducing Out-of-Pocket Healthcare Expenses

Many Ghanaians, particularly in rural areas, face high out-of-pocket healthcare costs. Without insurance, they must pay for medical services upfront, which discourages many from seeking timely treatment.

Microinsurance helps by:

✔ Covering essential medical costs, including hospital visits, medication, and emergency care.

✔ Providing financial security, so families don’t fall into debt due to healthcare expenses.

According to the World Bank, over 39% of health expenditures in Ghana are out-of-pocket payments. Expanding microinsurance coverage can significantly reduce this burden.

2. Complementing the National Health Insurance Scheme (NHIS)

Ghana’s NHIS has been instrumental in improving healthcare access, but it faces funding challenges, delays, and limited coverage for certain treatments.

Microinsurance can work alongside NHIS by:

✔ Covering treatments and medications that NHIS may exclude.

✔ Providing faster access to care without bureaucratic delays.

✔ Offering private healthcare options for those seeking quicker treatment.

For instance, BIMA Ghana offers mobile-based microinsurance solutions that provide policyholders with telemedicine consultations and health insurance coverage, filling gaps left by NHIS.

3. Expanding Coverage to the Informal Sector

Over 80% of Ghana’s workforce operates in the informal sector (market traders, artisans, farmers), and many do not have employer-provided health benefits.

Microinsurance makes healthcare accessible by:

✔ Offering flexible payment options through mobile money.

✔ Creating community-based insurance models for groups like traders and cooperatives.

✔ Providing low-premium policies that align with irregular incomes.

Companies like MicroEnsure Ghana and Vanguard Life have pioneered microinsurance plans specifically targeting this demographic.

4. Leveraging Mobile Technology for Greater Access

With over 44 million mobile connections in Ghana, mobile technology plays a crucial role in expanding microinsurance.

Many microinsurance providers partner with telecom companies to offer health plans via:

✔ USSD codes and mobile apps for easy registration.

✔ Premium payments through mobile money (MTN MoMo, Vodafone Cash, AirtelTigo Money).

✔ Instant claims processing for quick reimbursements.

A great example is MTN aYo Insurance, which provides life and hospital insurance through mobile subscriptions, making coverage affordable and accessible for millions.

Challenges Facing Microinsurance in Ghana

Despite its benefits, microinsurance faces some key hurdles:

1. Low Awareness and Trust Issues

Many Ghanaians, especially in rural areas, are unfamiliar with microinsurance or skeptical about its benefits. Education and awareness campaigns are crucial to increasing uptake.

2. Affordability and Sustainability

Even though microinsurance is designed to be low-cost, extreme poverty can still make it unaffordable for some. Providers must balance affordability with sustainability to keep services viable.

3. Regulatory and Infrastructure Barriers

The insurance regulatory framework in Ghana must evolve to:

✔ Encourage more innovation in microinsurance.

✔ Support digital solutions like mobile-based insurance.

✔ Ensure transparency and accountability to build public trust.

The National Insurance Commission (NIC) is already working on new policies to address these issues.

The Future of Microinsurance in Ghana

To maximize the impact of microinsurance in expanding healthcare access, key stakeholders must:

✔ Strengthen Public-Private Partnerships – More collaborations between insurance firms, telecom companies, and healthcare providers can expand access.

✔ Enhance Digital Innovation – Leveraging AI, blockchain, and mobile tech can improve efficiency and reduce fraud.

✔ Improve Government Support – Policies that incentivize microinsurance growth can help reach more uninsured Ghanaians.

The Ghanaian government, in partnership with Financial Sector Deepening Africa (FSDA) and the National Insurance Commission (NIC), recently launched initiatives to support insurtech start-ups focusing on microinsurance. These efforts will further drive adoption and accessibility.

Conclusion

Microinsurance is a powerful tool in Ghana’s journey towards universal healthcare access. By reducing financial barriers, complementing NHIS, and leveraging mobile technology, it ensures that even the most vulnerable populations can afford essential healthcare.

As awareness grows and innovative solutions emerge, microinsurance has the potential to transform Ghana’s healthcare landscape, offering a healthier, more financially secure future for millions.

What’s Next?

If you’re a business owner, informal worker, or an individual interested in securing affordable healthcare, explore microinsurance options with providers like:

✔ BIMA Ghana

✔ MTN aYo Insurance

✔ MicroEnsure Ghana

Would you consider microinsurance for your healthcare needs? Share your thoughts in the comments!