Wallet transfers are everywhere in Ghana now. When someone says “wallet transfer Ghana” or “send money via mobile wallet”, they’re talking about using mobile money services or digital wallets to move money between people, from abroad, or for paying bills, shopping, etc. It’s fast, mostly simple, and has become part of daily life for millions.

In this article, I’ll walk you through:

- What wallet transfer / mobile wallet means in Ghana

- Major players (MTN MoMo, Vodafone Cash, AirtelTigo Money, etc.)

- How wallet transfers work — local and international

- Key regulations & laws (e.g., E-levy, EMI guidelines)

- Fees, limits, and costs

- Benefits & challenges

- Practical tips, security best practices

- Future trends

Let’s dive in.

What is Wallet Transfer (Mobile Wallet) in Ghana?

A wallet transfer in Ghana generally refers to moving money via electronic or mobile wallets. That could be:

- transferring from one mobile wallet to another (person-to-person)

- moving money from a bank account to a mobile wallet or vice versa

- receiving foreign remittances directly into mobile wallets

- paying for goods or services using wallet funds

Mobile wallets are digital representations of money stored in a wallet service (often tied to your phone number), which allow you to send, receive, and store funds without necessarily using a traditional bank.

These services have become crucial because they make financial services accessible, especially for people who are unbanked or under-banked, or in rural areas without easy access to banks.

Mobile wallets in Ghana are regulated under the Bank of Ghana’s Electronic Money Issuers (EMI) guidelines, which ensure safety, security, and consumer protection. GCB Bank+1

Major Players & Wallet Providers in Ghana

Here are the key mobile wallets / electronic money issuers you’ll hear about:

- MTN MoMo – Probably the most popular mobile money wallet in Ghana. Many people use MoMo for P2P transfers, paying for utilities, merchant payments, etc.

- Vodafone Cash – Another widely used mobile wallet.

- AirtelTigo Money – Also important; although after various mergers the brand may evolve, but wallet services under that umbrella remain relevant.

- Other wallet/e-money issuers – There are regional and smaller fintechs, as well as mobile bank-wallet integrations.

Also, banks’ mobile apps sometimes offer wallet-like features or easy transfer to wallets. And international remittance operators partner with these wallets for inward transfers. Afriex+3Remitly+3Taptap Send+3

How Wallet Transfers Work in Ghana

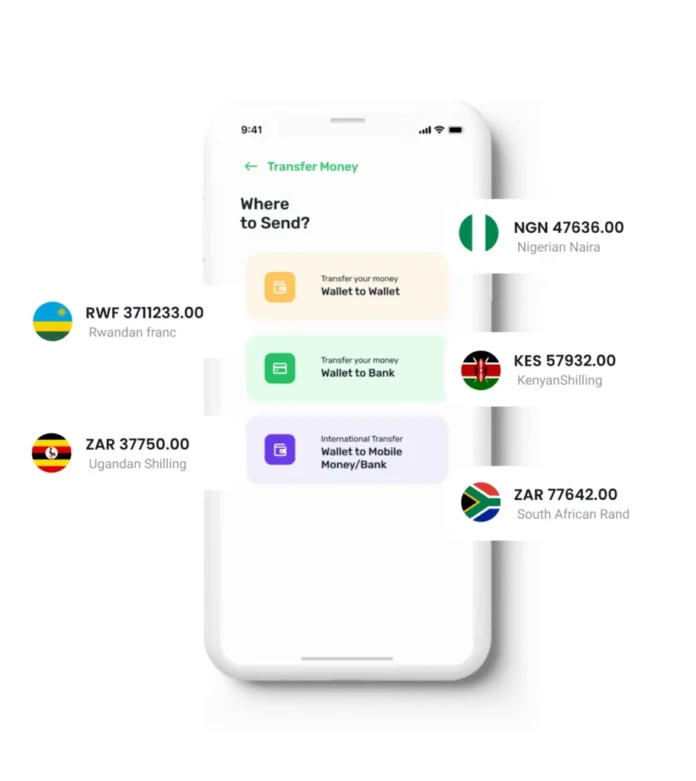

Wallet transfers can be grouped into local transfers (within Ghana) and international/inward remittances (sending money from abroad into Ghana).

Local Wallet Transfers

- Person-to-person (P2P): You send money from your mobile wallet to another person’s mobile wallet (same provider or different providers).

- Bank ↔ Wallet transfers: Move money from your bank account into your mobile wallet (to pay bills, buy airtime, etc.), or from mobile wallet to bank account.

- Merchant payments: Paying for goods or services using your wallet (via POS, QR codes, or paying to merchant-registered wallets).

These transactions are frequent and fast — often instantaneous for same-provider transfers. Different providers may have slight delays or charges when moving across different EMIs.

International / Remittances to Wallets

For people living abroad who want to send money to Ghana, many services now allow direct transfers to mobile wallets. Some of the major providers:

- Remitly – Users abroad can send to Ghana and choose mobile wallet (MTN, Vodafone, etc.) or bank deposit. Remitly

- Western Union – Offers transfers straight into MTN MoMo wallets and others. Very useful when family in Ghana need money fast. Western Union Money Transfer+1

- Afriex – Also supports mobile wallet transfers to some of the popular GH mobile wallets. Afriex

These services require verification (KYC), recipient wallet number, accurate names, maybe bank details, depending on the route. The money often arrives very quickly — sometimes instantly or within minutes, sometimes with delays depending on provider and country of origin.

Regulations & Laws: What You Need to Know

When doing wallet transfers in Ghana, there are legal and regulatory items to be aware of. Two big ones:

E-Levy (Electronic Transaction Levy)

- The Electronic Transaction Levy (E-levy) was introduced originally in Ghana via the Electronic Transfer Levy Act, 2022. It was a tax applied to many electronic/digital transfers including mobile money P2P transfers, merchant payments, bank transfers, etc. Afriwise+2Trade.gov+2

- The rate was something like 1.5% (though earlier drafts or proposals had 1.75%) on transactions above a threshold. Afriwise+1

- However: as of early 2025, the government under President John Mahama fulfilled a campaign promise to scrap the E-levy, betting tax, etc. So the E-levy is repealed. Wikipedia

Because E-levy has been repealed, many transfers will no longer incur that specific levy, which is good news for many users. But it’s important to check the latest status, because implementation in practice (systems, bank/wallet provider charges) might lag policies.

EMI / E-Money Issuers & Bank of Ghana Guidelines

- The Bank of Ghana’s Guidelines for Electronic Money Issuers/E-Money Issuer (EMI) Guidelines regulate how wallet/mobile money operators must operate. This includes consumer protection, security (e.g. PINs, KYC), interoperability, reporting, anti-money laundering (AML), etc. GCB Bank+2Bank of Ghana+2

- For international remittance into wallets (“inward remittance services”), the Guidelines for Inward Remittance Services by Payment Service Providers require providers (DEMI, EPSP) to comply with rules before partnering with Money Transfer Operators (MTOs). Bank of Ghana

These regulations help ensure your funds are protected, that transfers follow legal/AML rules, and that providers are accountable.

Fees, Transfer Limits & Costs

One of the biggest concerns for wallet transfers is cost. Here’s what you should know:

Transfer Fees

- Local P2P wallet transfers between the same provider are usually cheaper; cross-provider might cost more.

- Inward remittances often have fees (transfer fee, currency exchange fee, margin on FX). Some providers offer promotional “no-fee” transfers. For example, Western Union sometimes waives the fee for first transfers or certain corridors. Western Union Money Transfer

- Some services like Afriex advertise zero fees for certain wallet transfers. But they often make money via exchange rate margins. Always check the exchange rate and total cost to receiver. Afriex

Limits

Wallets impose limits to prevent fraud, and because of regulation. Examples:

- MTN Ghana has limits per transfer (e.g. very high ceiling for MoMo), while smaller providers or cross-provider transfers may have lower limits. RozeRemit

- Regulatory rules: sometimes maximum daily or monthly amounts are enforced.

- Also influences from inward remittance guidelines: the partner MTOs and ESPP/DEMI need to monitor large transactions for AML. Bank of Ghana+1

Benefits & Challenges of Wallet Transfers in Ghana

Benefits

- Convenience: No need to go to bank branches; can send/receive money any time from your phone.

- Speed: Transfers are often almost instant, especially local wallet to wallet or to a frequently used wallet provider.

- Financial inclusion: Mobile wallets have helped people without traditional bank accounts access digital financial services.

- Flexibility: Use for buying airtime / data, paying bills, person-to-person, merchant purchases, withdrawing via agent networks.

- Cross-border remittances: For Ghanaians abroad, being able to send to mobile wallets is a huge help for families back home.

Challenges & Risks

- Fraud / scams: Typing the wrong wallet number, phishing, social engineering; unauthorized withdrawals or transfers.

- Hidden costs: Even when fees seem low, exchange rates or margins might reduce how much the receiver actually gets.

- Connectivity / network issues: Some areas may have unreliable service; some wallets or providers may have downtime.

- Interoperability issues: Not all wallets are equal; cross-EMI transfers may cost more or be slower.

- Regulatory changes: Laws and taxes (like E-levy) may be passed, amended, or repealed. It’s important to stay updated.

Practical Tips & Best Practices

To make your wallet transfers in Ghana smoother, safer, and cheaper, here are some useful tips:

- Double-check recipient details

Always ensure that the phone number or wallet ID you’re sending to is correct. Typos can delay transfers or send money to the wrong person. - Know your wallet provider

Before doing a cross-wallet transfer (wallet to different wallet provider), check if there are extra charges or delays. Same-provider transfers (e.g. MoMo to MoMo) are usually the fastest and cheapest. - Compare fees and FX rates

Especially for international transfers, compare providers not just by their “fee” but by their exchange rate margin and total cost. Some “no-fee” offers still apply higher FX margin. - Stay abreast of regulation

Since E-levy was repealed recently, that impacts what you pay. But other rules could change. Always check the latest from credible sources (Bank of Ghana announcements, official provider notices). - Use secure channels

Use encrypted, official apps/websites. Don’t share PINs. Be wary of phishing messages or links. - Limit amounts when testing

If it’s your first time using a new provider or new country corridor, try sending a small amount first to verify everything works. - Keep receipts or transaction IDs

In case of errors, agents or customer service may need proof of the transaction.

Recent Developments / What’s New

- As noted, E-levy has been repealed (in 2025) by the current government. That was a campaign promise. So many wallet transfers that were going to pay that tax no longer will — though practice may lag policy. Wikipedia

- Guidelines on inward remittance services have been strengthened: Payment Service Providers partnering with Money Transfer Operators (MTOs) must meet certain standards (AML, security, settlement bank agreements). Bank of Ghana

- Many remittance services are making mobile wallet-based delivery more accessible / cheaper: e.g., Western Union sending directly to MTN MoMo; services like Afriex, Remitly improving support. Western Union Money Transfer+3Remitly+3Afriex+3

Example: How to Send Money via Mobile Wallet (Step-by-Step)

Here’s a simplified walkthrough of what a typical mobile wallet transfer might look like (local and inbound):

Local Wallet Transfer (Person-to-Person, Same Provider)

- Open the mobile wallet app (e.g. MTN MoMo).

- Select “Send Money” or “Transfer”.

- Enter recipient’s wallet phone number (make sure it matches their registered wallet).

- Enter amount.

- Confirm with your PIN / password.

- Check that the recipient has received the funds (they’ll often get a notification).

This usually takes seconds.

International Transfer → Wallet

- From provider abroad (Remitly, Western Union, Afriex etc.), select Send Money to Ghana. Choose mobile wallet as delivery option.

- Enter recipient’s wallet type (e.g. MTN MoMo, Vodafone Cash etc.), phone number, recipient’s name.

- Enter amount, see total cost including any fees / exchange rate.

- Provide your payment method (bank transfer, debit card, credit card).

- Confirm KYC or identity verification if requested.

- Send. Recipient should receive funds soon (some services deliver instantly; some may take minutes to a few hours depending).

Common Mistakes to Avoid

- Mistyping phone numbers or choosing wrong provider.

- Ignoring the impact of exchange rate margins — a “low fee” but bad rate can cost more.

- Overlooking provider limits (some wallets have caps per transaction / per day).

- Not noticing whether a transaction qualifies for waivers/tax exemptions. e.g., when E-levy was active, transfers under certain daily amounts or specific types were exempt. Ghana Revenue Authority+1

- Falling for scams: fake apps, phishing SMS, impersonation of providers, etc.

Is Wallet Transfer Secure?

Generally yes, but with caveats.

- Mobile wallet providers are regulated under EMI/Bank of Ghana rules, and need to have security protocols (PINs, encryption, KYC). GCB Bank+2Bank of Ghana+2

- But security depends on you: guarding your PIN, using only official apps or USSD codes, avoiding sharing sensitive info.

- Be careful with public WiFi, suspicious links, or unsolicited contacts.

- When sending internationally, use providers with good reputation, good reviews, and with clear fees and recourse in case of errors.

The Future of Wallet Transfers in Ghana

Wallet transfers are going to become even more integrated.

- Interoperability & cross-wallet transfers will become smoother. Wallets will likely conform more, so transferring between different providers is cheaper/faster.

- Fintech innovation: more apps, more ways to send money (QR, API, open banking).

- Reduced friction in remittances: more remittance services will push for instant wallet delivery.

- Mobile wallets beyond payments: savings, credit, insurance, etc. integrated in wallets.

- Regulatory evolution: laws will likely adapt (privacy, data protection, consumer protection, maybe even more bans / taxes / incentives).

Summary

Wallet transfers in Ghana are a game changer: fast, versatile, increasingly reliable. With providers like MTN MoMo, Vodafone Cash, AirtelTigo, plus the support of remittance companies (Remitly, Afriex, Western Union etc.), sending money locally or internationally is easier than ever.

Regulatory frameworks (EMI guidelines, inward remittance rules, and formerly the E-levy) help provide structure and protection. But you still need to stay informed, check your fees, double check recipient info, protect your access credentials, and pick providers you trust.

If you’re going to do a wallet transfer Ghana style, best advice: do your research, use secure means, and send smart.