In Ghana, having quality health insurance is vital to ensure access to medical care without devastating out‑of‑pocket expenses. Whether you’re an individual, a family, an SME owner, or a corporate employer, choosing the right health insurance provider can make all the difference. Ghana’s health insurance landscape includes the government‑backed National Health Insurance Scheme (NHIS) and a growing list of private insurers that offer broader coverage, private hospital access, and customizable plans.

Below is a detailed look at the best health insurance companies in Ghana in 2026, highlighting their strengths, typical offerings, and what types of customers they best serve.

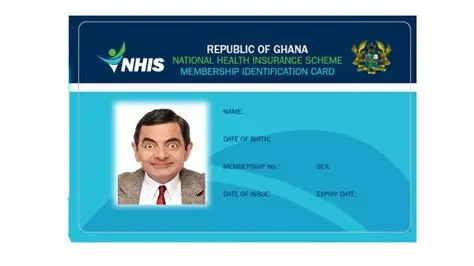

🇬🇭 1. National Health Insurance Scheme (NHIS)

The NHIS is Ghana’s official national health insurance policy aimed at ensuring equitable access to basic healthcare services for all citizens and legal residents.

✔ Best for: Universal basic coverage

✔ Pros: Affordable, widely accepted in public hospitals and many clinics

✔ Cons: Limited coverage for private hospital care and specialist treatment

➡️ Covers general outpatient services, maternity care, basic surgeries, emergency services, and some medications. It’s often the first line of health protection for most Ghanaians before opting for private top‑ups.

🏅 2. Acacia Health Insurance

Acacia Health Insurance is frequently ranked as one of Ghana’s leading private health insurers, known for its broad provider network and strong digital service delivery.

✔ Best for: Families, professionals, expatriates

✔ Pros:

- Comprehensive plans including maternity, dental, optical, specialist care

- Access to a large network of private hospitals

- Reliable digital claims and management tools

✔ Cons: Premiums can be higher than some competitors

Acacia has also been recognized for industry excellence, having earned awards for its impact and service quality.

🏥 3. GLICO Healthcare

GLICO Healthcare is backed by the trusted GLICO insurance group and is known for strong corporate and family health plans.

✔ Best for: Corporate clients, families

✔ Pros:

- Established brand with broad hospital acceptance

- Focus on preventive care and wellness benefits

- Digital tools for policyholders

✔ Cons: Slightly more geared toward group and corporate plans

💡 4. Apex Health Insurance

Apex Health Insurance is a rising name, gaining attention for affordability and tailored coverage that doesn’t compromise on essential benefits.

✔ Best for: Budget‑conscious families & individuals

✔ Pros:

- Affordable premiums

- Coverage includes outpatient, inpatient, and specialist services

- Growing network of clinics and partners

✔ Cons: Smaller network compared to larger brands

🏢 5. Enterprise Group / Enterprise Life Health Plans

Enterprise Group (via Enterprise Life and associated health packages) is one of Ghana’s oldest and most trusted insurance institutions.

✔ Best for: Nationwide reach and long‑term reliability

✔ Pros:

- Solid financial backing

- Branch network across Ghana

- Combines life and health insurance options

✔ Cons: Some plans may lack flexibility for individuals

👨👩👧 6. Premier Health Insurance

Premier Health Insurance is known for tailored group and individual plans and additional modern services like telemedicine consultations.

✔ Best for: SMEs, associations, corporate clients

✔ Pros:

- Telemedicine and diagnostic partnerships

- Focus on employee wellbeing plans

- Flexible coverage options

✔ Cons: Network coverage can vary by location

🩺 7. Metropolitan Health Insurance (MetHealth)

Under the Metropolitan Insurance Group, Metropolitan Health Insurance provides solid private health protection with both individual and corporate plans.

✔ Best for: Corporate clients & structured group schemes

✔ Pros:

- Strong insurance backing

- Reliable claims support

✔ Cons: Not as widely recognized among individuals

🧑⚕️ 8. Cosmopolitan Health Insurance

Popular among middle‑income families, Cosmopolitan Health Insurance focuses on accessible, family‑friendly healthcare.

✔ Best for: Families & individuals in urban areas

✔ Pros: Affordable family packages

✔ Cons: Smaller hospital network

🌍 9. Nationwide Medical Insurance (NMI)

Nationwide Medical Insurance has been recognized among Ghana’s leading corporate and private health insurers and is even listed among the top companies in the Ghana Club 100.

✔ Best for: Long‑standing private coverage

✔ Pros: Established reputation and tailored plans

✔ Cons: Presence strongest in major urban regions

🧑💼 10. Kaiser Global Health Ltd

Kaiser Global Health Ltd offers comprehensive and client‑focused health insurance, with coverage spanning outpatient, inpatient, dental, and more across Ghana’s regions.

✔ Best for: Extensive provider network users

✔ Pros:

- Over 400 accredited hospitals and providers

- Solid customer service track record

✔ Cons: Less brand visibility compared to larger insurers

🧠 Final Tips for Choosing Health Insurance in Ghana

✅ Understand your needs: Individual plans differ from family or corporate policies.

✅ Check hospital networks: Ensure the insurer partners with healthcare facilities you trust.

✅ Compare premiums vs. benefits: Affordable doesn’t always mean better coverage.

✅ Ask about digital tools: Many providers now offer apps for claims and policy management.